Want to master Portfolio Management? Be a PfMP, the highest-level PMI certification.

NEW Course available for it: PfMP Live Lessons Course - Guaranteed Pass or Money Back

The guarantee is linked to your passing the PfMP exam. NO T&Cs, except, you giving the PfMP exam!

The article follows.

--

While interacting with aspiring Portfolio Management Professionals (PfMP), some of the questions that come-up are these:

- Why should a Portfolio be worried about benefits and benefits management?

- Is not benefits management part of a Program with a dedicated domain?

Also, in the PMBOK Guide, 6th edition as well as 7th edition, benefits management has been informed in many places! Indeed, in the PMBOK Guide, 6th edition aspiring Project Management Professionals (PMP) specifically need to know about the Project Benefits Management Plan, which acts as input while building the project charter.

In addition, (Project/Product) Managers and Scrum Master speak mostly in terms of features, not benefits! In this article we will understand the importance of benefits and its significance in portfolio management.

Features Vs. Benefits

First the key distinction between features and benefits:

A feature is something available in a product or service, whereas a benefit is something you gain from the product or service.

Let's take a few examples to understand:

- A chatbot in a Web-Site is a feature, but the 40% reduction in customer response time due to the chatbot is a benefit.

- Spell-check is a feature in a word-crunching software, but error-free document built with the software is a benefit.

- Taking a day-to-day example, reverse-osmosis (RO) in a water-purifier is a feature, but drinkable and much better quality water because of the RO are benefits.

So, while features are needed and prioritized depending on the framework/methodology followed, customers or buyers only understand in terms of benefits. Isn’t it?

For example, when you buy a water-purifier with RO functionality, your first question is this – “how does it benefit me?” You, as a customer, are not much worried about the technicalities or nitty-gritties of RO, but really care about the benefits before you make the purchase decision. In fact, for any product you buy, you actually look for benefits coming from the features provided in the prouct!

So, benefits are important not only for project or program management, but also portfolio management.

Benefits Realization and Portfolio Manager

As a portfolio manager, you need to clearly know both the fiscal and non-fiscal benefits to your organization. Of course, you must have a sound understanding of your organization’s vision, mission, goals, strategies and associated objectives. This will help you to understand not only benefits management, but also aid in benefits realization and optimization of benefits realization.

Specifically considering portfolio benefits, portfolio value is delivered when benefits coming from portfolio components (e.g., projects, programs, operations) are realized in the hands of portfolio beneficiaries such as customers. Value is generated when beneficiaries use the benefits. And I can’t emphasize the below figure enough.

As shown above, benefits translate to value. And it’s this value that your organization gets when the customer pays for its worth.

Now, a portfolio manager must understand how to relate an organization's strategic goals, objectives (or simply strategic objectives) and priorities with the portfolio component plans such as project or program management plan to achieve the organization’s strategic objectives.

But why and how so?

The answer to it lies in the Benefits Dependency Map (BDM). The benefits dependency map is also called the Benefits Break-down Structure (BBS).

The Benefits Dependency Map

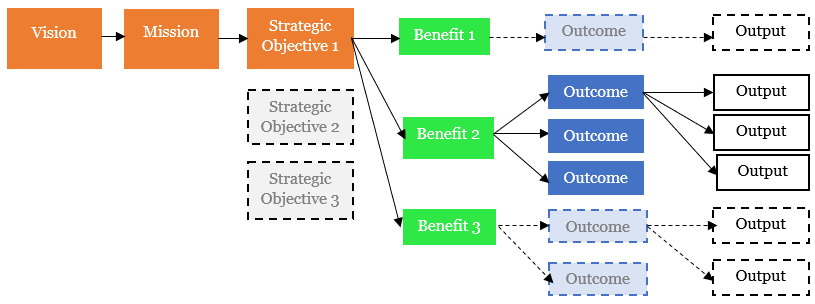

The vision (future state) and mission (purpose) of an organization along with the strategic objectives of an organization are documented in the Organization's Strategic Plan. Some of these strategic objectives are met by a portfolio and they are documented in the Portfolio Strategic Plan.

When you build the BDM/BBS, your starting point will be from the vision, mission and strategic objectives leading to benefits. This is shown below.

As shown in the above figure, the vision and mission lead to the strategic objectives of an organization. Each strategic objective of an organization will be met when the benefits are delivered. In our case:

- Strategic Objective 1 is achieved when Benefit 1, Benefit 2 and Benefit 3 are delivered.

- Similarly, Strategic Objective 2 and Strategic Objective 3 will be achieved when the associated benefits are delivered.

These are noted in the Portfolio Benefits Realization Plan and/or the Portfolio Performance Variance Report, which is one of the key Portfolio Reports.

But then, who delivers these benefits?

The benefits are delivered by the portfolio component programs and component projects.

Remember that a program is a set of interrelated projects or subprograms managed together to give you benefits, which is otherwise not possible if you manage them independently. And a project is a temporary endeavor which gives a unique product, service or result (output).

So, we are going to expand our previous BDM figure.

"How-Why" Logic of Benefits Dependency Map

I’ve expanded the previous, initial-cut BDM to include the outcomes and outputs. It’s depicted below.

As shown above:

- Benefit 1 will be achieved with one outcome coming from the output, i.e., from a project, program or subprogram.

- Benefit 2 will be achieved with three outcomes coming from three outputs – again from project or program.

- Benefit 3 will be achieved with two outcomes coming from two outputs – again from project or program.

As you move from left to right in the above BDM, the question is "how", i.e., how will this strategic objective be met with these benefits? But when you move from right to left, the validity of the BDM is verified by asking the question “Why?”. For example, why should we take this component project.

This "how-why" logic helps to structure the map. This also clearly shows the link between your organization's delivery capability with projects and strategic objectives.

To know more on benefits, outcomes and outputs, you can refer to this article of Fundamentals of Value-Driven Delivery. Though this linked article is with respect to projects using Lean/Agile approaches such as Scrum or Kanban, the fundamental concepts are very much applicable for waterfall or hybrid projects.

Final Words

So, there it is!

At the portfolio level, we also talk about benefits, benefits management and benefits realization, because only at the portfolio level we make decisions on which component to take, drop, suspend or resume based on the expected benefits from the components.

These benefits help in achieving the organization’s strategic business objectives, which in turn helps in meeting the vision and mission of the organization.

References

[1] NEW Book – I Want To Be A PfMP, the plain and simple way, by Satya Narayan Dash

[2] The Standard for Portfolio Management, by Project Management Institute (PMI)