Portfolio Risk Management differs significantly from project and/or program risk management. While there are similarities among the processes, procedures, actions in risk management, risk management in portfolio differs in many areas. In this article we will learn the foundational aspects of portfolio risk management.

Portfolio Risk Definition

As per PMI, following is the definition of Portfolio Risk:

An uncertain event, set of events, or conditions that, if they occur, have one or more effects, either positive or negative, on at least one strategic business objective of the portfolio.

Re-read it again! It looks similar to the definition of project risk in that a risk is an uncertain event or condition, if it occurs, will positively or negatively impact one or more objectives of the project.

However, considering a portfolio, the considerations are not with respect to just objectives, but strategic business objectives. Why so?

Because a portfolio is different from the project. A portfolio is a collection of projects, programs, sub-portfolios managed as a group to achieve the strategic business objectives of the organization.

Hence, as you can see, the definition speaks about at least one strategic objective. If the uncertain event/condition doesn’t impact one, then it’s NOT a portfolio risk!

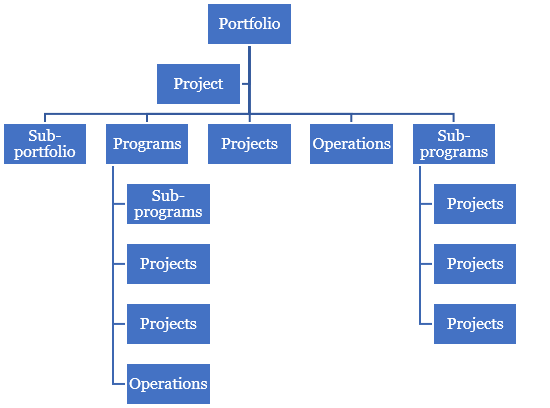

Another aspect is with respect to the set of events. A portfolio can have a number of components, such as projects and programs as depicted in the below figure.

There will be intra-dependencies among the components of the portfolio. At the same time, a group of initiatives taken by an organization can be clubbed to form a portfolio. There can be many such initiatives. So, there can be interdependencies among the portfolios.

Considering both interdependencies and intra-dependencies (mentioned in the PfMP exam's ECO or Exam Content Outline), you can have a set of events.

Portfolio Risk Management

Next, you’d be wondering about Portfolio Risk Management. Again, let’s start with the definition.

Considering the Standard for Portfolio Management, Portfolio Risk Management is a knowledge area with processes to develop the Portfolio Risk Management Plan and manage the portfolio risks.

I’ll define Portfolio Risk Management as follows:

Portfolio Risk Management consists of a set of processes to conduct risk management planning, risk identification, risk assessment, risk response and risk monitoring of a portfolio.

As you can notice in the definition, Portfolio Risk Management consists of the key areas of planning, identification, assessment, response as well as monitoring.

The Standard for Portfolio Management, 3rd edition has two processes for it as shown in the below figure.

While the process of “Develop Portfolio Risk Management Plan” creates the Portfolio Risk Management Plan, the process of “Manage Portfolio Risks” creates the needed risk related files such as Portfolio Risk Register and Portfolio Risk Reports.

These are separate and independent documents and part of Portfolio Process Assets. Portfolio Risk Reports can also be part of Portfolio Reports, which is a must-know as you prepare for your PfMP exam.

The objectives of Portfolio Risk Management are to increase the probability and impact of positive events and decrease the probability and impact of negative events to the portfolio value, strategic fitness of the portfolio and optimization/balancing of the portfolio.

Next, let’s see the differences between Portfolio Risk Management and Project Risk Management.

Differences: Project Vs. Portfolio Risk Management

There are a number of differences, in fact a very large number of them. I’ve outlined a few of them in the below table.

Conclusion

Indeed, there are a lot of differences between portfolio risk management and typical project/program management. Some differences are completely unique, for example, equity protection at the portfolio level. There are also quite a few similarities, but as I’ve noted earlier while managing risks for the portfolio, your thinking and mindset has to be different.

To know and understand portfolio management with a single figure, you can refer to this article.

Portfolio Management - One Figure That Says it All!

I hope this article gives you the fundamental understanding with respect to Portfolio Risk Management and you understand the intricate basic differences between portfolio and project risk management.

To have a detailed understanding on Portfolio Risk Management, you can refer to the newly available book: I Want To Be A PfMP.

References:

[1] PfMP Exam Prep Book – I Want To Be A PfMP, the plain and simple way, by Satya Narayan Dash

[2] Article: Portfolio Governance Management - Key Governance Processes and Interactions, by Satya Narayan Dash

[3] Article (Book Excerpts): Understanding Portfolio Strategic Management, by Satya Narayan Dash

.png)

.png)

.png)

.png)

.png)

.png)

.png)